Home

Plenty Motion and Serious Movement at the CBN – Toni Kan

Published

5 months agoon

By

shybellmedia

The Igbo people have a proverb; the way the morning dawns tell us how the rest of the day will go and if we look at how Yemi Cardoso’s 2025 dawned, we can safely surmise that 2025 is going to be a busy, productive, impactful year at the apex bank.

It is also an important one, leading up as it does to the conclusion of the banking capitalization exercise announced on March 28, 2024 and due to conclude on March 31, 2026. In the last week of January, Zenith Bank announced that it had raised a total of N350.4 billion through its recently concluded hybrid Rights Issue and Public Offer.

With other banks concluding their capitalization plans,2025 is already shaping up as an exciting year for the financial health of Nigerian banks with interesting outcomes expected.

As 2025 dawned, the Central Bank of Nigeria (CBN) signaled that it will no longer be business as usual. For years, Nigerian business entities and their regulators across sectors have enjoyed, what can almost be described,as a cosy and incestuous relationship. For the banking and finance industry that hand-in-glove dalliance seem to have assumed frightening dimensions in the recent past.

With Cardoso, there has been a clear line drawn in the sand. The apex bank will carry out its function as banker to the banks without caring who is impacted.

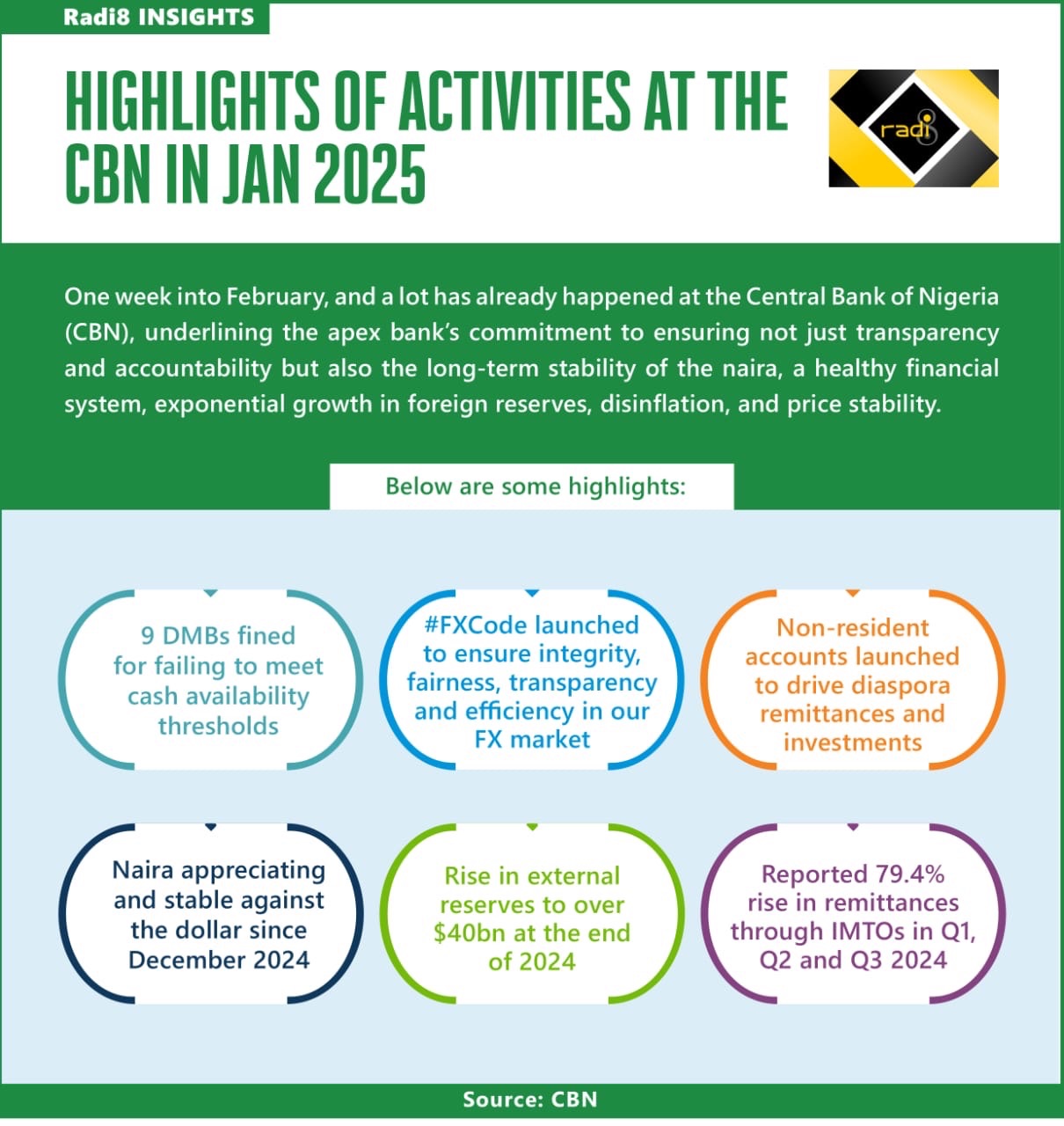

That message resonated early this year when nine deposit money banks were fined by the CBN for failing to meet cash availability thresholds during the Christmas period.

The CBN had via a circular dated November 29, 2024: “Cash Availability Over the Counter in Deposit Money Banks (DMBs) and Automated Teller Machines (ATMs)” directed DMBs to ensure efficient cash disbursement to customers Over the Counter (OTC) with the CBN insisting that it will enforce the directive and ensure compliance.

A statement from the apex bank read: “In a clear message of zero tolerance for cash flow disruptions, the Central Bank of Nigeria (CBN) has sanctioned Deposit Money Banks (DMBs) for failing to make Naira notes available through automated teller machines (ATMs), during the yuletide season. Each bank was fined N150 million for non-compliance, in line with the CBN’s cash distribution guidelines, following spot checks on their branches.”

The sanctioned banks are Fidelity Bank Plc, First Bank Plc, Providus Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, Keystone Bank Plc, Union Bank Plc, Globus Bank Plc, and Sterling Bank Plc. Totaling N1.35 billion, the fines will be debited from the DMBs’ accounts with the apex bank.

To underline its commitment to transparency and accountability, the CBN reiterated its vision of remaining “a trusted and respected Central Bank promoting confidence in the Nigerian economy, contributing to a stable, inclusive, and competitive nation.”

According to the CBN governor, “As we shift from unorthodox to orthodox monetary policy, the CBN remains committed to restoring confidence, strengthening policy credibility, and staying focused on its core mandate of price stability.”

To achieve these aims especially with regard to the FX market, the CBN has taken some bold and innovative decisions.

Mid-January, the apex bank “launched the Nigeria Foreign Exchange Code #FXCode – marking a decisive step forward for integrity, fairness, transparency and efficiency in our FX market. The FX Code is built on six core principles: ethics, governance, execution, information sharing, and risk.

The CBN has also cleared the verified FX commitments, which amounted to $7 billion, “discontinuing the Central Bank’s quasi-fiscal interventions and unifying the multiple exchange rate windows.”

The immediate effect has been a Nigerian currency that has maintained stability since the festive period with an over N40 appreciation over the green back. This has led the Chairman, Senate Committee on Banking, Insurance and Other Financial Institutions, Senator Mukhail Adetokunbo Abiru, to commend the CBN for its “efforts in ensuring stability in the foreign exchange market,enhancing liquidity and reducing market distortions.”

The CBN’s focus on diaspora remittances received further boost with the launch of the diaspora account. The launch is significant as it signposts Cardoso’s penchant for following through with promises made. He had hinted at the coming of the diaspora account in a series of disclosures and announcements on the sidelines of the IMF/World Bank meetings in October.

The launch was conveyed via a January 10, 2025 circular. Introduction of Non-resident Nigerian Ordinary Account and Non-resident Nigerian Investment Account. The accounts aim to not just encourage and increase diaspora remittances they are also designed to help Nigerians in the diaspora take advantage of investment opportunities in-country. Analysts believe that this will be a game changer which will impact not just remittances but the foreign reserves as well as the overall economy.

The Non-resident Nigerian Ordinary Account (NRNOA) will allow Non-Resident Nigerians (NRNs) to remit their foreign earnings to Nigeria and manage their finances in both foreign and local currencies while the Non-resident Nigerian Investment Account will facilitate investments in Nigerian assets using either foreign currency or naira.

The announcement is getting positive feedback and to ensure adequate awareness and facilitate uptake in the target audience, the CBN hierarchy has held consultations with Abike Dabiri Chairman/CEO of Nigerians in Diaspora Commission (NiDCOM) who has applauded the move as a “a strategic initiative to enhance diaspora engagement and bolster Nigeria’s economic growth.”

Before the announcement of the new diaspora targeted accounts the CBN had laid the groundwork for seamless implementation by working with the Nigerian Inter-Bank Settlement System (NIBSS) to launch a non-resident Bank Verification Number (BVN) platform to enable Nigerians in diaspora operate their local bank accounts.

In mid-2024, the CBN reported an all-time high diaspora remittance inflow of $553m and the CBN had on the back of that set a $1bn monthly diaspora remittance target. How is that target being met? Speaking at the Monetary Policy Forum with the theme, “Managing the Disinflation Process” in Abuja, Cardoso noted that “remittances through IMTOs rose 79.4% to US$4.18 billion in the first three quarters of 2024, demonstrating the positive impact of FX reforms. Additionally, the CBN lifted the 2015 restriction barring 41 items from accessing FX at the official market to enhance trade and investment.”

As February dawns and economic activities resume fully what is the outlook? With inflation at 34.80% and the MPR at 27.55, the IMF, according to thecable.ng, has projected that Nigeria will record GDP growth of 3.2 percent in its economic growth forecast for 2025. But the CBN is more optimistic with a projection of 4.17 percent according to a presentation by the bank at the ‘National Economic Outlook: Implications for Businesses in 2025.”

The apex bank’s optimistic forecast is anchored on a cocktail: ongoing fiscal and monetary reforms, sustained implementation of government reforms, steady crude oil prices, and improvements in domestic oil production as well as hopes of a stable exchange rate.

Cardoso and his team are singing clearly from the same hymn book. In his speech on Thursday, January 30, 2025 when he hosted the Monetary Policy Forum 2025, the CBN governor was upbeat as he spoke to the theme: “Managing the Disinflation Process”

The CBN governor emphasised that the goal of the CBN is to ensure that monetary policy remains forward-looking, adaptive, and resilient. “Our focus must remain on price stability, the planned transition to an inflation-targeting framework, and strategies to restore purchasing power and ease economic hardship. The CBN is continuing its disciplined approach to monetary policy, aimed at curbing inflation and stabilizing the economy. These actions have yielded measurable progress: relative stability in the FX market, narrowing exchange rate disparities, and a rise in external reserves to over $40 billion as of December 2024.”

Collaboration, Cardoso noted, remains key to success. “In addressing our economic challenges, collaboration is key: “Managing disinflation amidst persistent shocks requires not only robust policies but also coordination between fiscal and monetary authorities to anchor expectations and maintain investor confidence.”

The subtext from that interaction as well as the ongoing innovations and initiatives is simple; achieving success is a marathon and not a sprint and reaching the finish line requires resilience.

***Toni Kan is a PR expert and financial analyst.

Related

You may like

-

Access Bank’s Unlawful Account Freezing: Customer Gets Substantial Compensation

-

CITITRUST HOLDINGS, 3 other Companies in Massive Money Laundering Saga

-

PalmPay, Glo unveil “Recharge and Win Bonanza 2” to reward customers

-

ZENITH BANK ASSURES INVESTORS ON EXIT FROM CBN’S REGULATORY FORBEARANCE BY 30TH JUNE, RESTATES COMMITMENT TO CONTINUED DIVIDEND PAYMENT

-

Ecobank Staff Jailed Over N2.4m Cyber Fraud